Member-only story

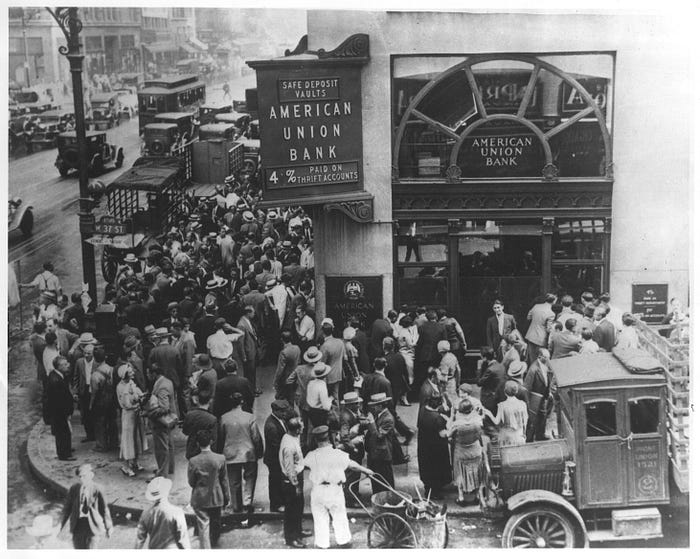

Banking 101: What You Need to Know, and What Causes Bank Runs

Basic banking explained: It’s all about trust

In the Christmas classic, It’s a Wonderful Life, George Bailey, played by Jimmy Stewart, is about to embark on his honeymoon when he notices a run on his bank, Bailey Brothers Building and Loan. He rushes to the bank where he is greeted by a mob of customers, frantically looking to withdraw their money. He tries to calm them down and delivers perhaps the most succinct explanation ever of what a bank does (here’s the clip on YouTube). “You’re thinking about this all wrong, as if I have the money back in a safe. The money’s not here. Well your money’s in Joe’s house, that’s right next to yours, and the Kennedy house, and Mrs. Maklin’s house, and a hundred others. You’re lending them the money to build, and they’ll pay you back as best they can.” We take banks for granted, until they’re in the news, like in March 2023 with the collapse of Silicon Valley Bank and others. But most of us don’t really understand what a bank does, and how fragile the banking system is. Well, read on — Banking 101 explains everything you need to know about banking, but were afraid to ask.

So, how does a bank make money?

Let’s say I want to start Steve’s bank. It takes in deposits and makes loans. The loans are assets of the bank and the deposits are liabilities —…